“All you need to get the money is a cellphone number or email address. When you report a scam, the FTC can use the information to build cases against scammers.“Because money can be transferred so quickly into someone else’s bank account, these P2P platforms are the perfect payment mechanism for scammers,” said John Breyault at (a project of the National Consumers League). Then, report it to the Federal Trade Commission. If you sent money to a scammer, report the scam to the mobile payment app and ask them to reverse the transaction right away. What to Do If You Sent Money to a Scammer

If you need to speak to someone, you will need to contact support through the mobile app. There usually is no direct support line for cash apps, so stay away from any website claiming to be vendor support. If anyone who claims to work with these vendors requests this information, it is a red flag. The vendor will never ask you to disclose personal information, such as a PIN or card number. Remember: never give out your personal information. The cash apps will allow you to set up a PIN or fingerprint to make transactions, turn on two factor authentication, and utilize email and text notifications so that you will be notified of any suspicious behavior. One of the best ways to protect your personal information is to set up security features. So, even if you mistakenly send cash to the wrong person, often they will be unable to cancel the transaction or refund you the money. Keep in mind that all transactions with these apps are instant and cannot be cancelled. It can be easy to use these apps for payment of services or goods, but it is much safer to transfer money between family and friends. When sending someone cash through cash apps, make sure you only send cash to someone you know and double-check that their username is correct. Authentic giveaways and sweepstakes will never request that you send cash to verify identity report any social media account claiming this, as it is a scam. Giveaways and sweepstakes are fun, and if you decide to participate in one, make sure you know the rules and verify its legitimacy.

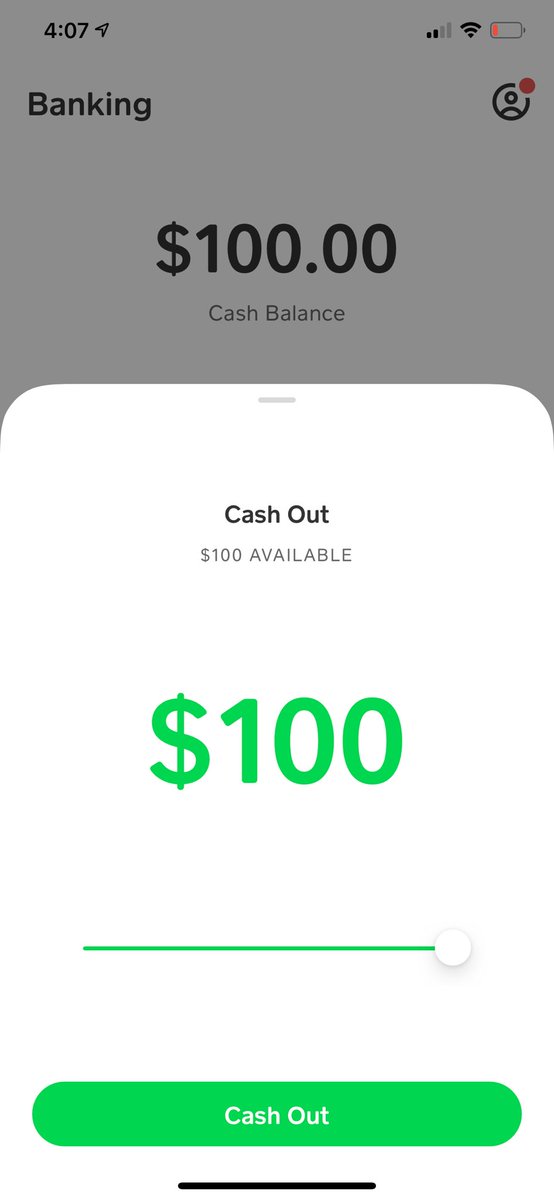

We know how convenient it is to use P2P digital solutions, and we want you to use them safely! Here are some things to remember and keep in mind as you spend. That’s why they’ll tell you to wire money or pay them with reload cards, gift cards or through a mobile payment app. Scammers want you to pay in a way that’s quick and makes it hard for you to get your money back. These scammers will often claim to be influencers or say that they want to help other people during a difficult time and give back, only to take advantage of unknowing individuals. Scams have been heightened during the COVID-19 pandemic, as many find themselves in need of fast cash. However they do not come without risk, they have recently come under fire as reports of fraudulent behavior are making headlines. You can link your bank accounts, credit or debit cards and instantly send money to someone, making for a quick and easy transfer.Ĭash apps are a popular choice among consumers, as the interface is easy to use and navigate it allows users to quickly send someone money, receive money, or invest in stocks. These apps allow you to transfer and receive money from friends and family, all with the click of a button. Peer-to-Peer (P2P) mobile payment services, such as Venmo, Zelle, and Cash Apps, have become popular digital solutions for everyday consumers. Suffolk County Community College Partnership.MasterCard® Business Rewards Credit Card.Home Equity Loans & Lines-of-Credit (HELOC).

0 kommentar(er)

0 kommentar(er)